Could a Summer in London Make You a UK Tax Resident?

Understanding UK residence rules so you don’t become ‘accidentally’ resident in the UK.

Summer in London is an alluring prospect, offering a respite from the extreme heat of the Middle East or the rainy season in the tropics. However, it is crucial to understand how a seemingly innocent summer sojourn can inadvertently render you a UK tax resident, resulting in unforeseen tax liabilities.

When Einstein remarked, "the hardest thing in the world to understand is the income tax," he could well have been referring to the current rules on residency.

In this article, I will outline the three-step Statutory Residence Test (SRT) and highlight some key considerations – days, home ownership, family ties, hours worked - to be aware of, ensuring you do not ‘accidentally’ become UK resident.

The article concludes with a list of factors that you should meticulously document if you are a frequent visitor to the UK.

The Statutory Residence Test

The straightforward 90-day average rule was abolished in 2013 and replaced by the Statutory Residence Test (SRT). The SRT determines your residency status through a series of assessments: the automatic overseas tests, the automatic UK tests, and the sufficient ties test. Unsuspecting visitors are most often ensnared unexpectedly by the sufficient ties test. The tests are applied sequentially, and if you satisfy one test, there is no need to proceed to the next.

Please note, this article is intended for general awareness and should not be considered tax advice.

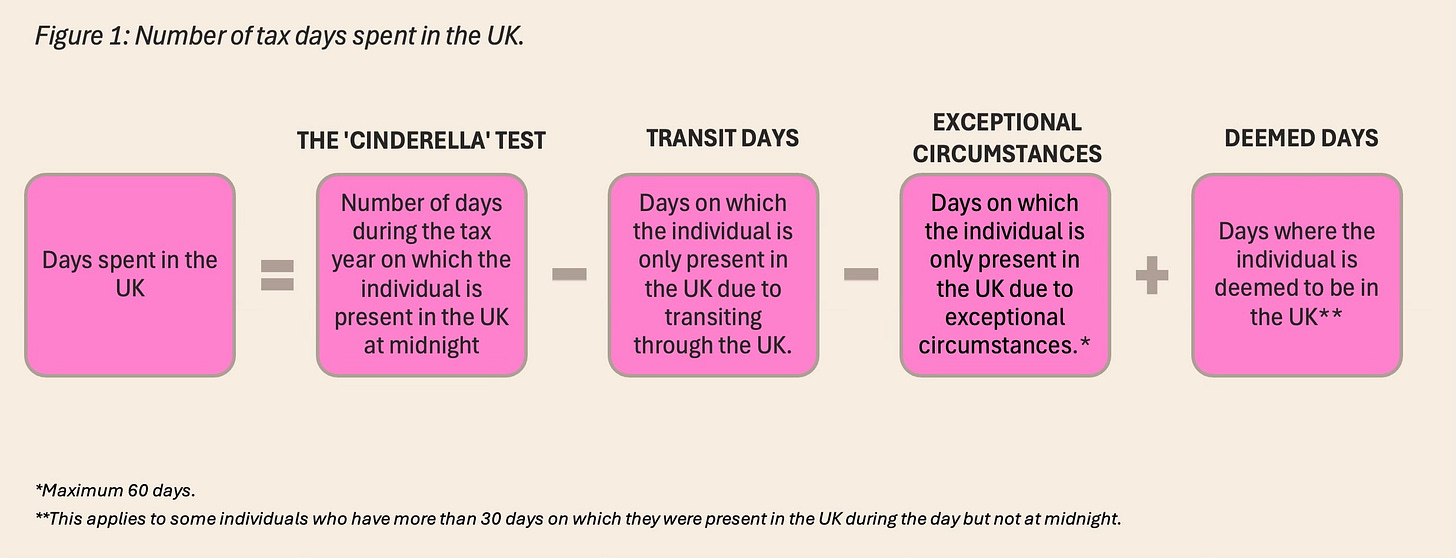

Number of Days in the UK

The first thing you need to determine is the number of days you spent in the UK.

Automatically Non-Resident

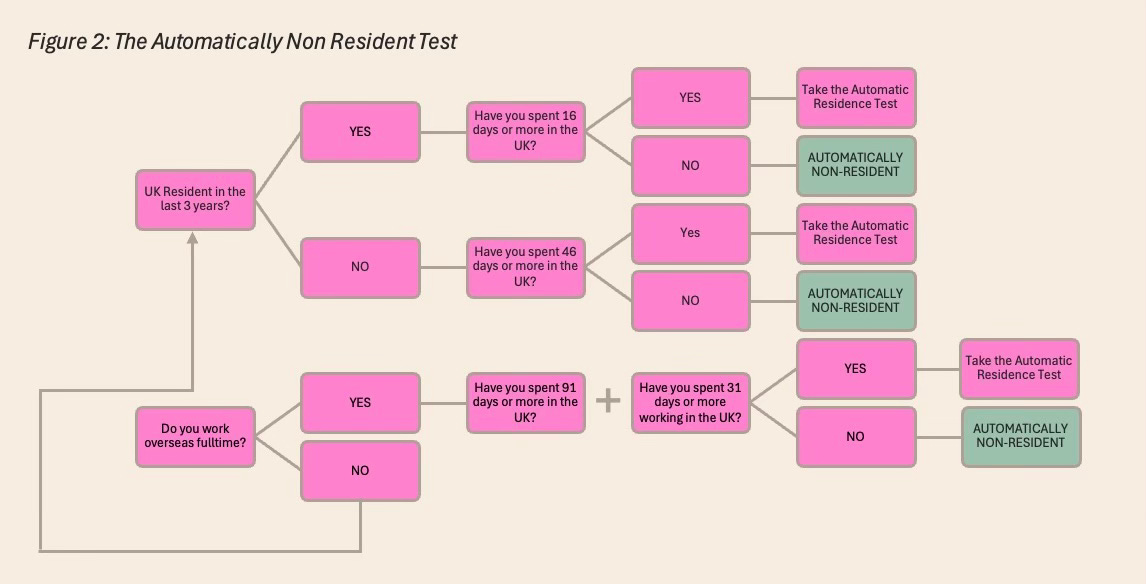

Once you have calculated the number of days you have spent in the UK (figure 1), you can begin the Statutory Residence Test. In the first instance, HMRC evaluates whether you meet any of the automatic overseas tests.

To be automatically considered non-resident, you can spend just 16 days in the UK if you were a UK resident in one or more of the previous three tax years.

This increases to 46 days if you were not UK resident in any of the previous three tax years.

But you may automatically non-resident be non-resident if work full time overseas AND spend less that 91 days in the UK of which only 31 of those days can be workdays.

Should you satisfy any of these criteria, you are not classified as a UK tax resident for that tax year.

Unsure about your status? Refer to Figure 2 to ascertain whether you might satisfy the criteria for the UK Automatic Non-Residence Test.

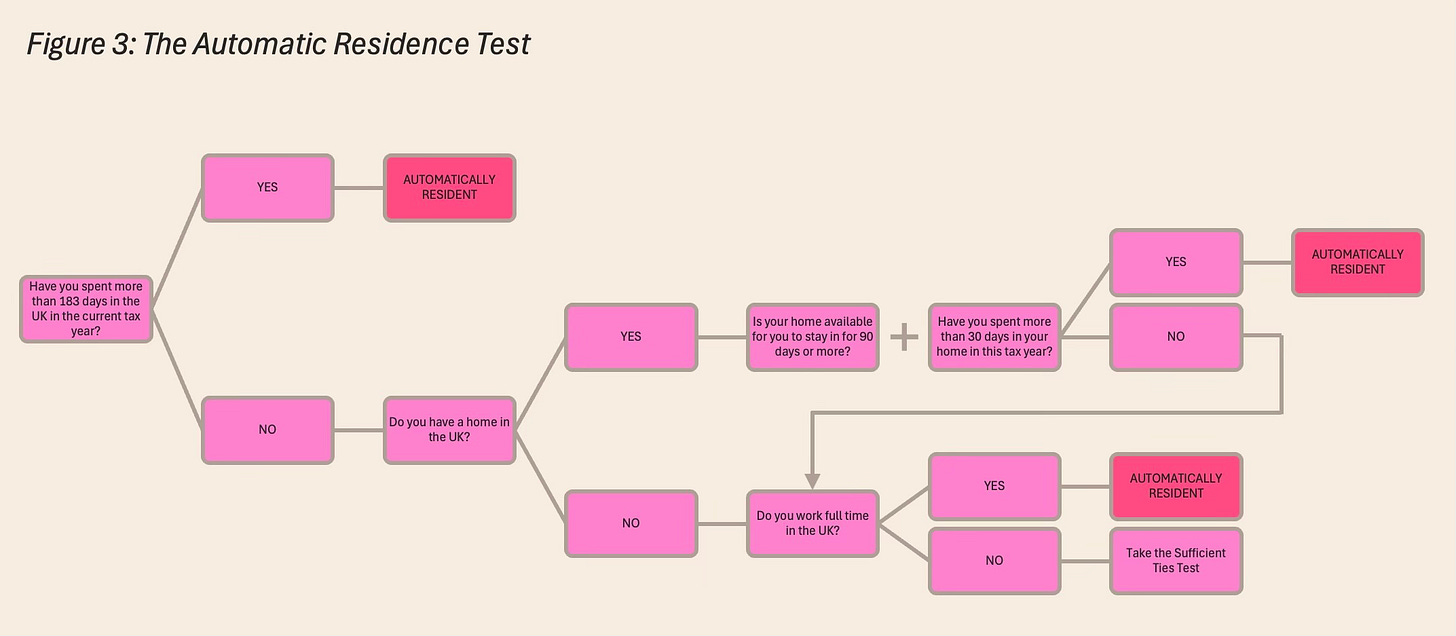

Automatically Resident

Should you not meet any of the automatic overseas tests, HMRC will then assess whether you fulfil any of the automatic UK tests.

Did you spend 183 days or more in the UK?

Is your only home in the UK? For these purposes HMRC defines your ‘only home’ as a place you spend 30 days or more in during the tax year AND you owned it for a period of at least 91 consecutive days (of which 30 or more fall within the relevant tax year.

Do you work full time in the UK? Full time is defined as 75% of your working days are spent in the UK.

If you meet any of these criteria, you will be deemed a UK tax resident for that tax year.

Still uncertain of your status? If the tests in Figure 2 (the automatic non-residence test) did not determine you as a non-resident, refer to Figure 3 to ascertain where you may be considered 'automatically' resident."

‘Accidentally’ Resident

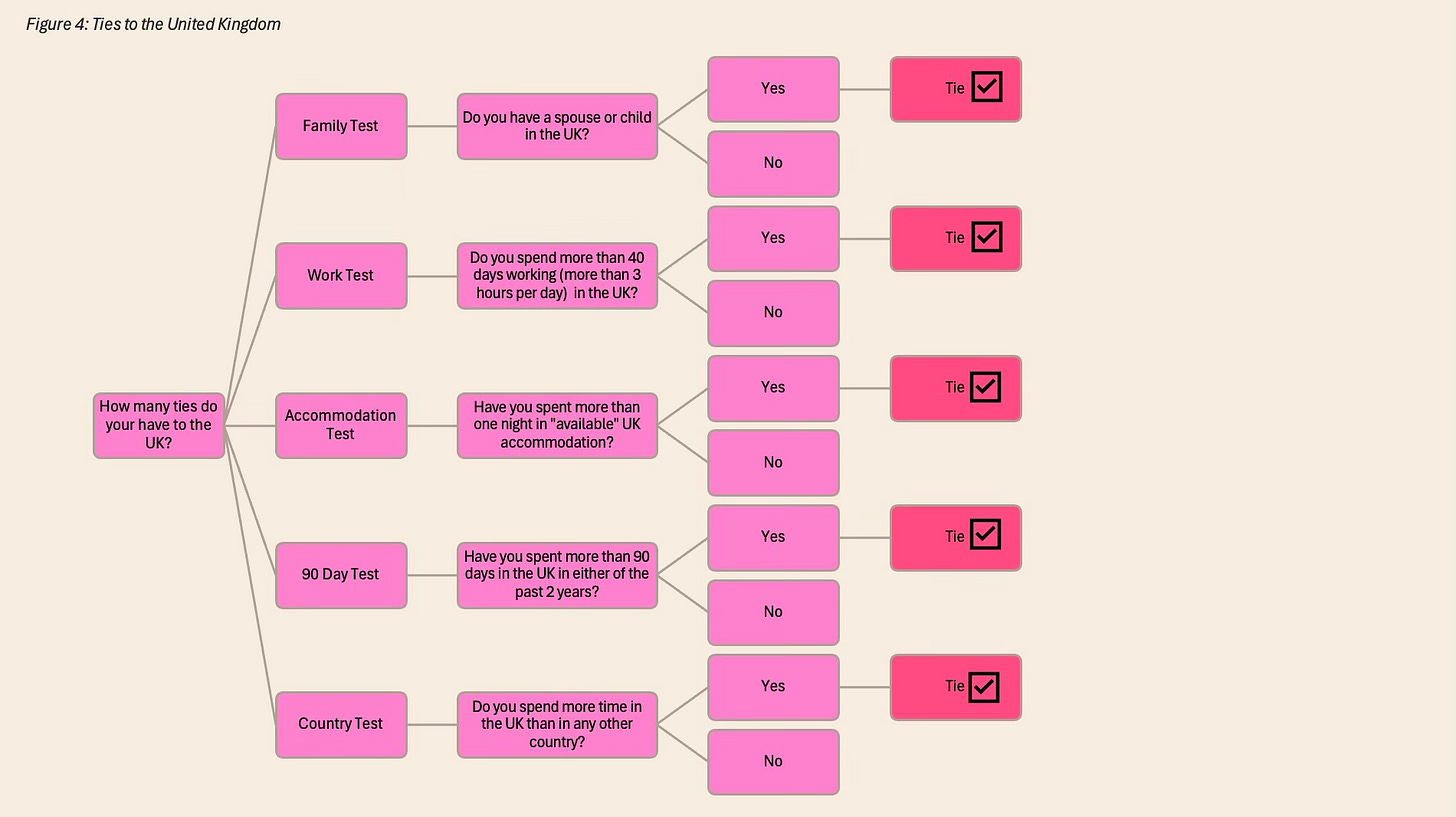

This is the danger zone. Failing to meet any of the automatic tests (Figures 2 & 3) necessitates the application of the sufficient ties test, which examines the number of days spent in the UK, the nature of your ties to the UK and considers whether you were UK resident in any of the previous three years.

A staged approach is recommended. You should have already:

Calculated the number of days you spent in the UK (figure 1),

Applied the automatic residence tests (figure 2),

Applied the automatic non-residence tests (figure 3).

Next,

Determine how many "ties" you have to the UK (figure 4),

Review your residence status for the past three years.

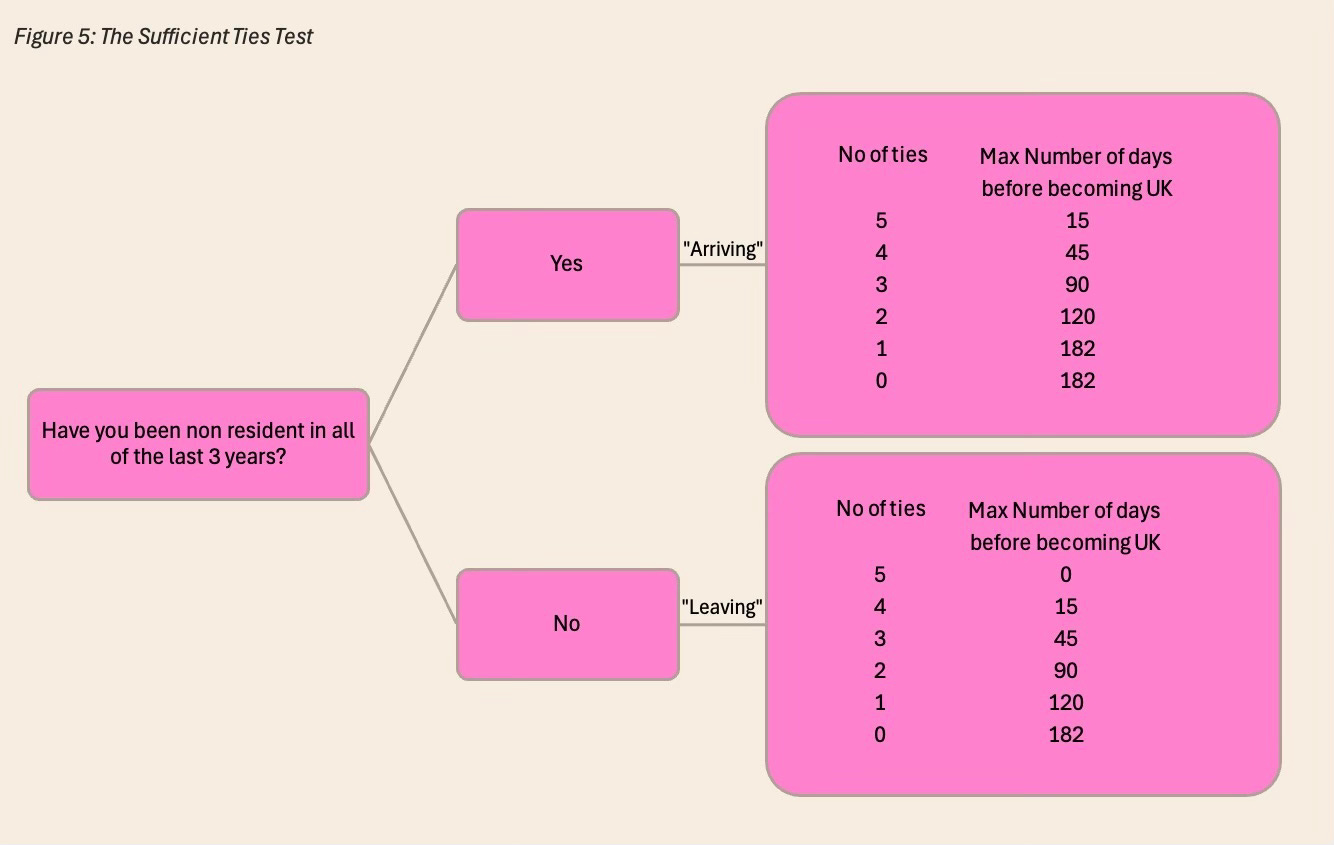

Ties + Days = how many days you can spend in the UK without becoming a resident for tax purposes (figure 5).

The 5 Ties

A child in school in the UK, a home or even just working more than 3 hours a day can all create ties for the purposes of the sufficient ties test. Each tie reduces the amount of time you can spent in the UK without becoming a UK resident for income tax purposes.

The Family Tie

A family tie exists if your spouse, civil partner, common-law partner, or minor children reside in the UK. For minor children, a tie is not created if the child spends 21 days or less in the UK outside of term time.

For example, if your child attends a boarding school in the UK and your spouse visits frequently, your spouse could create a tie by exceeding their allowable number of days in the UK. Similarly, your child could create a tie by spending more than 21 days in the UK during school holidays.

The Accommodation Tie

An accommodation tie is present if have accommodation available to you in the UK for at least 91 consecutive days, and you spend at least one night there in the tax year. This includes properties owned or rented by you.

This is differs to the ‘only-home’ test for automatic residence. It includes places you have access to, even extended hotel stays!

Even properties owned by other family members can result in a tie. If you spend more than 16 nights with family (for example an adult child), you will have an accommodation tie.

The Work Tie

A work tie is established if you work in the UK for at least 40 days in a tax year. A workday is defined as any day where you work for more than three hours.

Beware, if you arrive in the UK, immediately head to a meeting and leave the same day, this will count as a work day if the meeting lasts longer than three hours.

The work tie threshold is 40 days, whereas the automatic residency test uses 31 days. This discrepancy underscores the complexity of the rules and the necessity for professional advice.

The 90-Day Tie

If you spent more than 90 days in the UK in either of the previous two tax years, this creates a 90-day tie.

Be careful to limit the length of extended summer stays if you visit the UK throughout the year as the 90-day tie test is cumulative.

The Country Tie

The country tie applies if the UK is the country where you spend the most days in the tax year compared to any other single country.

For example, you spend 120 days a year in the UK. The rest of the year you spend 90 days in New York (work), 15 days in Monaco (the Grand Prix), 15 days in Switzerland (skiing), 30 days in Jamaica (over Christmas and New year) and 95 days in Sydney (work). This would give you a country tie to the UK.

Confused? Use figure 4 to determine how many ties you have to the UK.

Now you have calculated how many days you spent in the UK and how many ties you have to the UK. But are you resident? Well, that depends on your resident status in the last 3 tax years.

Figure 5 sets out how many days you can spent in the UK without becoming resident based on your ties to the country and tax status in the previous three years.

Keep detailed travel records

The legislation is complex, confusing and ambiguous in places. Anyone who thinks they may become an ‘accidental’ resident should keep stringent records and get professional tax advice.

Days in the UK at midnight: Keep a log of days spent in the UK for the days tally with evidence such a boarding passes and passport stamps.

Family Days: Record days spent by close family members to avoid being caught out by unknowingly creating an additional tie.

Accommodation Details: Ensure you have details of where you stayed on trips to the UK as owning a property or staying regularly with friends or family can impact your status.

Work Days: A second log of workdays may also be necessary to make sure you don’t breach the 40-day work rule. Remember you can be present for work but not present for the day.

Potential deemed days Record: You are only entitled to 30 days where you are present in the UK but not at midnight. Above 30 days, these days begin to count as deemed days and add to your day count total.

For example, you take the Eurostar into London in the morning and leave every evening. Technically this is not a day spent in the UK because you were not present at midnight. However, you can only do this on 30 occasions before HMRC start to count these as deemed days.

Travel Days: If you travel a lot, you may also need a log to ensure you don’t breach the country tie. Keep a record of your location are at midnight every day to ensure you do not spent more days in the UK than in any other country.

The rules are complex, and this article does not provide an exhaustive list of all the regulations. Furthermore, this article does not replace the necessity for professional tax advice, rather, it emphasises the need for advice especially if you are in danger of becoming an ‘accidental resident’.