Cryptocurrency: Making cents or making no sense at all?

Seven things you need to understand about cryptocurrencies

“Bitcoin is a technological tour de force.” – Bill Gates

Cryptocurrencies, also known as digital or virtual currencies, have become a buzzword in recent years. They are a type of decentralised digital asset that uses cryptography to secure and verify transactions, and control the creation of new units. The most well-known cryptocurrency, Bitcoin, was created in 2009. However, there are now thousands of different cryptocurrencies available, each with their own unique features and uses.

This is the first in a series of articles on virtual currencies that I will publish weekly.

I. “Cryptocurrency: Making cents or making no sense at all?” introduces cryptocurrencies and explains the key concepts.

II. “Breaking down crypto lingo: ‘HODL’, ‘FOMO’, and other ridiculous terms.” explains some of the main terms used by crypto enthusiasts.

III. “Crytpo vs CBDCs: it’s like comparing the informal economy to the formal economy.” illustrates the main differences between cryptocurrencies and central bank digital currencies.

If you are new to the world of cryptocurrencies, here are seven essential things you should know:

Cryptocurrencies are decentralised

One of the most important features of cryptocurrencies is that they are decentralised. This means that they are not controlled by any government or financial institution, unlike sovereign currencies such as the US dollar or euro. Instead, they are dictated by computer code and maintained by a network of users and computers around the world.

Sovereign risk is a significant concern for those who engage in decentralised activities. This is evident from past events such as the 1933 prohibition of gold ownership by US President Franklin D. Roosevelt, which led to a sharp drop in gold prices. Another recent example is China's ban on cryptocurrency trading and mining, which was implemented in September 2021, and the subsequent introduction of their own digital currency, the digital yuan. Such actions by governments can have a significant impact on the value of decentralised assets, and individuals should be aware of the risks involved when engaging in activities that lack official backing.

Cryptocurrencies use blockchain technology

Cryptocurrencies are powered by blockchain technology, which operates as a specialised form of database. The blockchain captures and stores every transaction as a block that is added to the chain, where it is validated and immutably recorded by every computer in the network, a distributed digital ledger. This combination of cryptographic security and distributed digital ledger technology promotes transparency, as every user is able to view the transactions that have taken place, and ensures that the system is secure and tamper-proof.

Cryptocurrencies can be used to buy goods and services

While cryptocurrencies are not yet widely accepted as a form of payment, many businesses are starting to accept them. You can use cryptocurrencies to buy goods and services online, and some brick-and-mortar stores also accept them. However, it's important to note that not all cryptocurrencies are accepted everywhere, so you should check before trying to use them as a form of payment.

Cryptocurrencies can be volatile

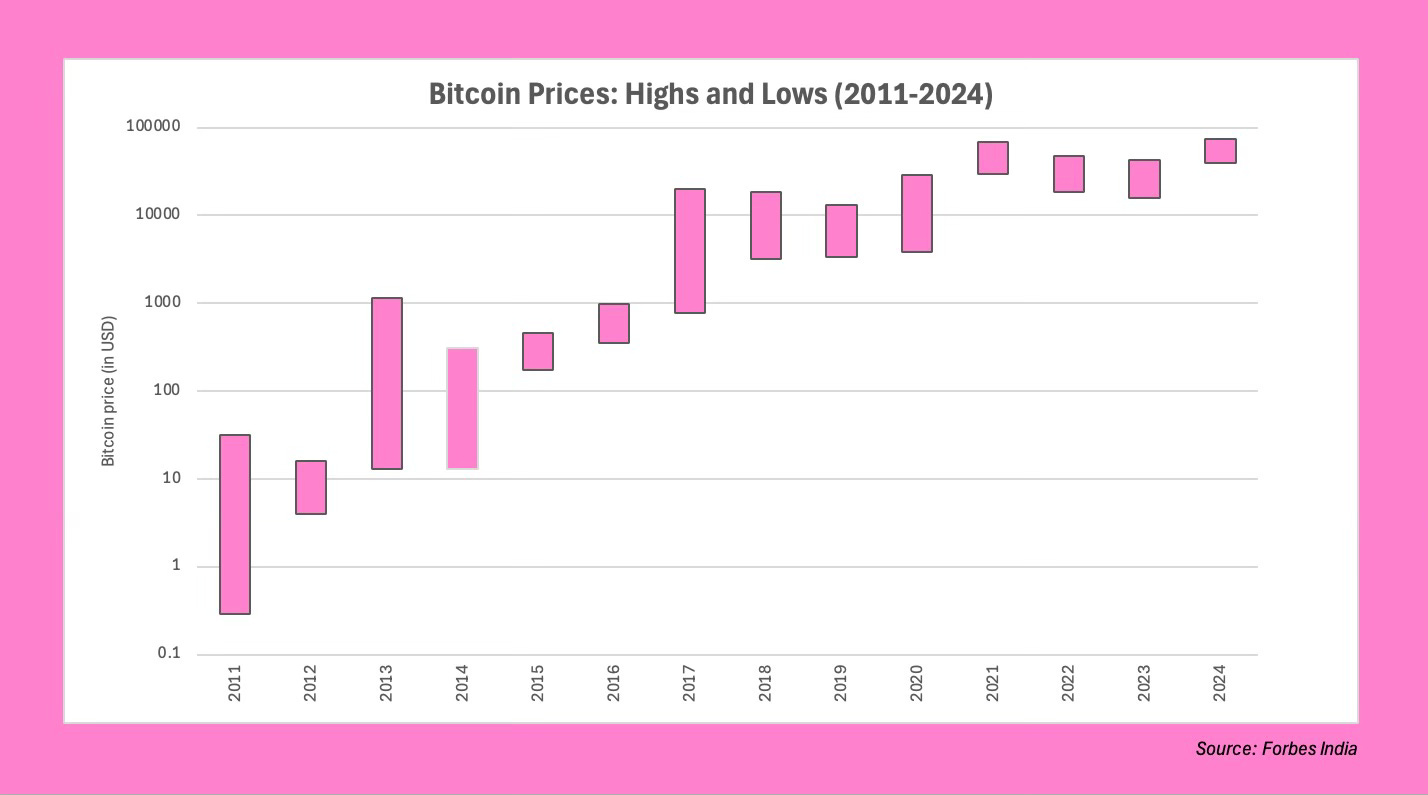

The volatile nature of cryptocurrencies remains one of the primary factors hindering their adoption in commerce, and presents a significant risk for investors. Due to their lack of backing from a physical asset, government, or established payment system, the value of cryptocurrencies can fluctuate rapidly and unpredictably. This leaves them vulnerable to the influence of various external factors, including news events, market sentiment, and the actions of other investors.

Cryptocurrencies like Bitcoin has seen their fair share of ups and downs over the years, the chart below shows bitcoin price approximate highs and lows from 2011 to 2024. There was very little movement, with the price hovering around zero from it’s creation in 2008 until 2010.

Current Bitcoin price on 29th June 2024 is 1BTC : $60,882.20

Cryptocurrencies can be bought and sold on exchanges

If you want to buy or sell cryptocurrencies, you can do so on a cryptocurrency exchange. These exchanges allow you to trade one cryptocurrency for another, or for traditional currencies such as the US dollar or euro. However, it's important to do your research and choose a reputable exchange, as there have been cases of exchanges being hacked, failing to segregate client assets or shutting down.

Cryptocurrencies require a digital wallet

To store and manage your cryptocurrencies, you will need a digital wallet. This is a software program that stores your public and private keys, which are used to send and receive cryptocurrencies. There are different types of wallets available, including desktop wallets, mobile wallets, and hardware wallets.

It is important to remember that these are usually tied to devices, meaning that if you lose the device, you lose your cryptocurrency. Famously, James Howells threw away an old hard drive which had 7,500 bitcoin stored on it. Today, 7,500 bitcoin is worth approximately $457 million!

Cryptocurrencies can be mined

Mining cryptocurrency is the process of verifying and adding transactions to the blockchain. This process involves using computer hardware and specialised software to solve complex mathematical problems, which requires a lot of computational power.

Miners are rewarded for their efforts with newly created cryptocurrency coins, which can then be sold or held as an investment. In essence, mining is the backbone of the cryptocurrency network, as it helps to maintain the integrity and security of the blockchain by validating and recording transactions.

Final Thoughts

Cryptocurrencies are a new and exciting development in the world of finance. While they have the potential to revolutionise the way we make transactions and store value, they are still a relatively new and volatile asset class. If you're interested in investing in cryptocurrencies, it's important to do your research and understand the risks involved.