“An era can be said to end when its basic illusions are exhausted” – Arthur Miller

Are virtual forms of payment like Google Pay, Apple Pay, and virtual currencies signalling the end of the “cash is king” era? Cryptocurrencies have been making headlines for years now, disrupting traditional finance and challenging the very notion of what money is. But in recent years, a new challenger has emerged: the Central Bank Digital Currency (CBDC).

In this article, the final in my series on virtual currencies, I'll explain what a CBDC is, compare it to cryptocurrencies, and define important terms like fiat currency. Earlier articles in this series covered:

Part I, “Cryptocurrency: Making cents or making no sense at all?” introduced cryptocurrencies, and explained the key concepts; and

Part II, “Breaking down crypto lingo: ‘HODL’, ‘FOMO’, and other ridiculous terms.” explains some of the terms used by crypto enthusiasts.

What is a CBDC?

A Central Bank Digital Currency (CBDC) is a digital version of a country's fiat (normal) currency that is issued and backed by its central bank. Unlike cryptocurrencies, CBDCs are issued by a government or central authority and are backed by the full faith and credit of the issuing government. CBDCs are typically designed to function like physical cash, but in a digital form.

One key feature of CBDCs is that they can be used for government purposes, such as distributing social welfare payments, which can help reduce costs and improve efficiency. CBDCs are also designed to be more secure and provide greater transparency than traditional fiat currency.

Fiat Currency

To understand the differences between cryptocurrencies and CBDCs, it's important to define the term "fiat currency." Fiat currency is a government-issued currency that is not backed by a physical commodity, such as gold or silver. Instead, it is backed by the full faith and credit of the issuing government.

Fiat currency is the most common form of currency in the world today, and is used for everyday purchases, investments, and government transactions. Examples of fiat currency include the US dollar and euro.

Cryptocurrencies vs CBDCs

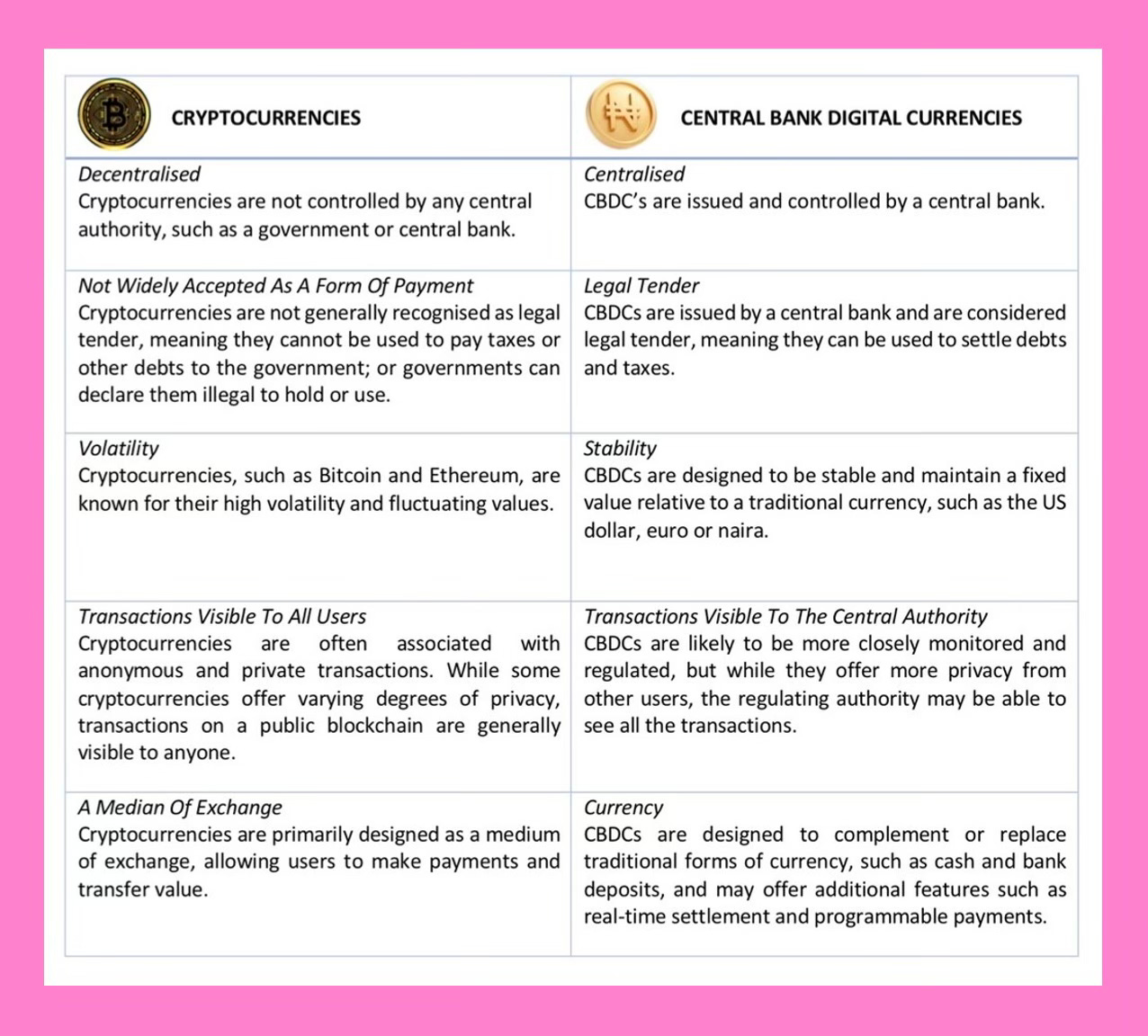

Cryptocurrencies and CBDCs share some similarities, such as being digital and using blockchain technology to record transactions. However, there are some important differences between the two.

Final thoughts

Cryptocurrencies and CBDCs are both digital currencies, but they differ in several important ways. CBDCs are centralised and issued by a government or central authority, while cryptocurrencies are decentralised and not backed by any government or central authority. CBDCs and cryptocurrencies are both designed to function like physical cash and be used as a medium of exchange or store of value.

Understanding the differences between cryptocurrencies and CBDCs, as well as key terms like fiat currency, can help investors and everyday consumers navigate the complex world of digital currency and make informed decisions about their finances.