Things Fall Apart: Chinua Achebe, W.B. Yeats, or Nigeria today? In fact, it pertains to all three. Like in Achebe’s seminal novel, where traditional structures and norms collapse under external pressures and internal mismanagement, Yeats’s evocative lines penned in 1919—”Things fall apart; the centre cannot hold; Mere anarchy is loosed upon the world,”—resonate powerfully today in Nigeria. Yeats could hardly have imagined that his metaphorical disintegration would reflect the tumultuous situation now unfolding in Nigeria, Africa’s largest economy. As 2024 progresses, Nigeria teeters on the brink of hyperinflation, with its economic foundations under severe stress, mirroring the chaos Yeats prophesied and the societal breakdown Achebe depicted.

Nigeria is not alone, Argentina, Iran, Lebanon, Turkey, and Venezuela among others continue to grapple with hyperinflation. Nigeria joins Pakistan and Egypt on the watch list, with economists concerned they might reach similar states of economic turmoil before the year ends.

This article explores the application of IAS 29, the accounting standard that guides entities in their financial reporting under hyperinflationary conditions. I explore the challenges addressed by IAS 29, its triggers in turbulent economic conditions and conclude with seven practical tips for businesses in economies with spiralling inflation.

Defining Hyperinflation: Economists vs. IAS 29

Economists traditionally define hyperinflation as a situation where the inflation rate exceeds 50% per month. At this rate, prices double approximately every 51 days, leading to a rapid erosion of a currency’s purchasing power.

However, IAS 29 does not adhere strictly to this 50% threshold. Instead, the standard provides broader criteria to determine when an economy is hyperinflationary, considering qualitative factors rather than a fixed numerical threshold.

According to IAS 29, an economy is considered hyperinflationary if, among other indicators:

The general population prefers to keep its wealth in non-monetary assets or in a relatively stable foreign currency.

Prices are quoted in a stable foreign currency.

Sales and purchases on credit take place at prices that compensate for the expected loss of purchasing power during the credit period, even if the period is short.

Interest rates, wages, and prices are linked to a price index.

The cumulative inflation rate over three years approaches or exceeds 100%.

These criteria allow for a more nuanced assessment of hyperinflation, accommodating different economic contexts and stages of inflation.

What is Cumulative Inflation?

Cumulative inflation is a critical concept in the application of IAS 29. It refers to the total increase in prices over a specific period, typically measured over three years for assessing hyperinflation. To calculate cumulative inflation, the formula involves multiplying the inflation rates for each year within the period:

Cumulative Inflation=(1+Inflation Rate Year 1)×(1+Inflation Rate Year 2)×(1+Inflation Rate Year 3)−1.

Case Study: Nigeria on the verge of hyperinflation?

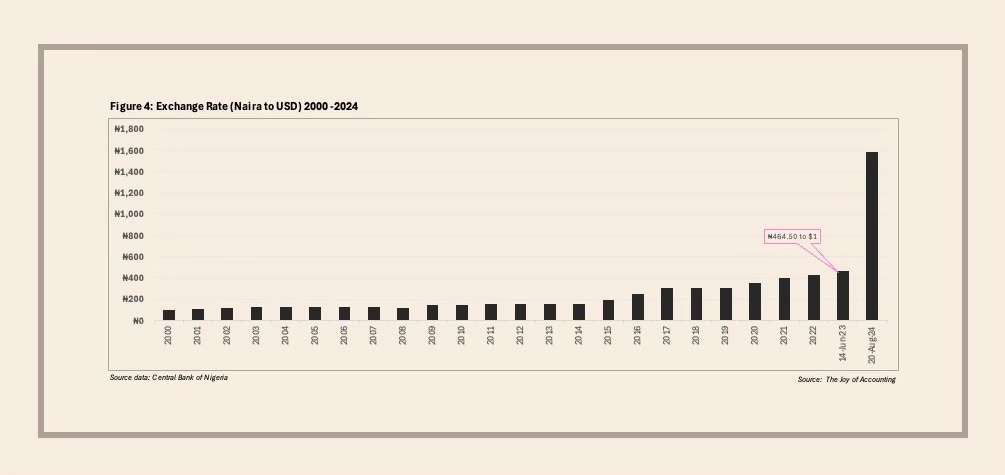

Nigeria, the largest economy in Africa, is currently facing severe inflationary pressures that are driving it perilously close to hyperinflation. In recent years, the country has experienced a sharp and sustained rise in inflation, attributable to several factors including the devaluation of the Naira following the floatation of the exchange rate, escalating fuel costs due to the removal of the fuel subsidy, poor agricultural yields, and significant supply chain disruptions.

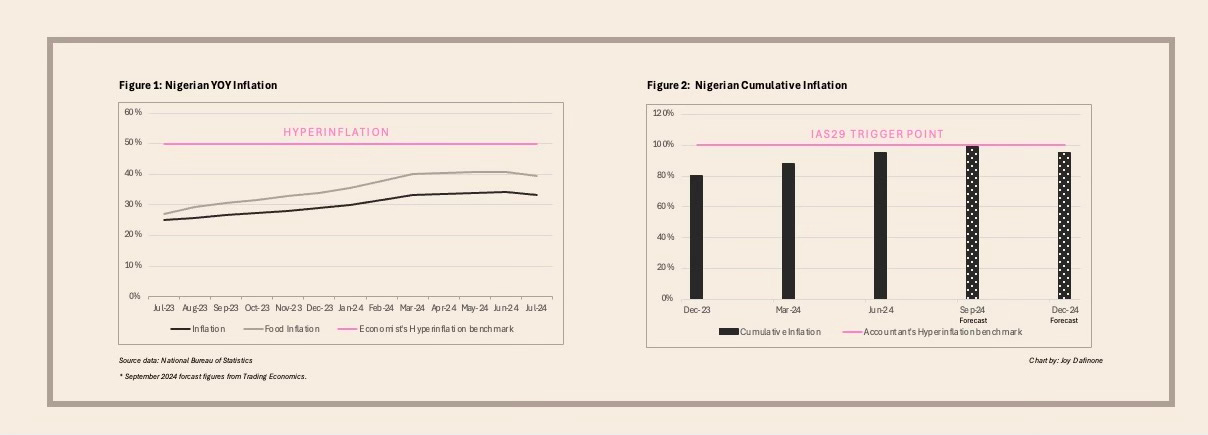

In July 2024, Nigeria's inflation rate marginally decreased to 33.40%, down from 34.19% in June 2024, marking the first reduction since late 2022. Nevertheless, inflation remains considerably above the Central Bank of Nigeria's year-end target of 21.4%.

95% Cumulative inflation as at June 2024

As illustrated in Figure 2, cumulative inflation reached 95.56% by June 2024, indicating that Nigeria is on the cusp of hyperinflation. This situation demands close scrutiny, and it may be prudent for Nigerian accountants to revisit IAS 29. While cumulative inflation is a critical factor in determining the application of IAS 29, it is by no means the sole criterion.

Setting aside the nearly 100% cumulative inflation, it is clear that inflationary pressures are intensifying at an alarming rate.

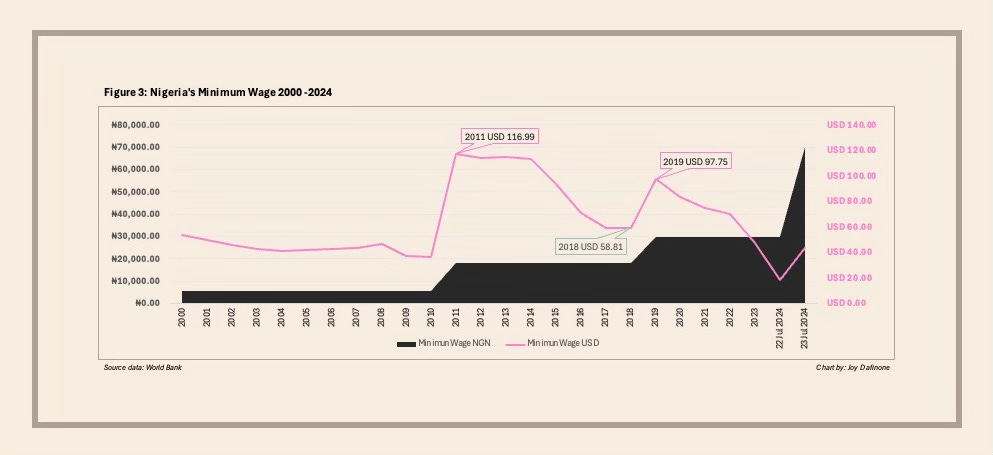

133% Minimum Wage increase in July 2024

The 133% increase in the minimum wage in July 2024 (Figure 3) suggests the onset of a wage-price spiral, worsened by skyrocketing fuel prices and import prices. Fuel prices tripled overnight following the removal of the fuel subsidy in May 2023.1 Subsequently, the Naira exchange rate was floated, leading to an almost 250% depreciation against the dollar (Figure 4).2

These developments are likely to intensify inflationary expectations rise—the 'Being is Believing' effect. As former Federal Reserve economist Dr Marvin Barth explains, “If everyone believes inflation will be higher, producers are much more likely to raise prices and consumers more willing to accept them (without switching brands), regardless of other things going on in the economy.”3 The prevalence of bulk buying in Nigeria is a clear manifestation of this belief, as it signals that consumers expect prices to continue rising, thereby further fuelling inflation. The middle class has even begun bulk buying in groups to make purchases more affordable amid rampant inflation4.

#EndBadGovernance Protests in August 2024

Consequently, Nigeria's economic challenges are far from resolved. The recent decrease in inflation, though seemingly encouraging, must be viewed with caution, especially in light of the "End Bad Governance" protests that signal ongoing socio-political instability. The full impact of the recent wage increase on inflation also remains uncertain and may well catapult cumulative inflation over the 100% threshold, so Nigeria remains a country firmly on the hyperinflation watchlist.

The Impact of Hyperinflation on Financial Reporting

In a hyper-inflationary economy, traditional financial reporting methods become inadequate. Historical cost accounting, where assets and liabilities are recorded at their original purchase price, fails to reflect the true financial position of a company.

IAS29 abandons the historical cost accounting concept

This is because inflation rapidly erodes the value of monetary items, distorting the financial statements.

IAS 29 addresses these challenges by requiring companies to restate their financial statements in terms of the measuring unit current at the end of the reporting period. This process involves:

Restating Non-Monetary Items: Assets and liabilities that are not monetary in nature, such as property, plant, and equipment, are restated to reflect their current value.

Restating Income Statement Items: Revenues, expenses, and other income statement items are adjusted to reflect the effects of inflation during the reporting period.

Restating Equity: Share capital, reserves, and other equity items are restated to reflect their value at the end of the reporting period.

Monetary Gain or Loss: IAS 29 requires the recognition of a monetary gain or loss that arises from holding monetary items during periods of hyperinflation. This is the difference between the purchasing power of monetary items at the beginning and end of the period.

Restatement of prior year comparatives: Figures for the previous reporting period must be adjusted so that the comparative financial statements are presented in terms of the current measuring unit as of the end of the reporting period.

Managing Business Operations in a Hyper-inflationary Environment

Navigating the complexities of a hyper-inflationary economy demands strategic adjustments and meticulous planning to ensure financial stability and adherence to accounting standards such as IAS 29; therefore, I have outlined some essential tips to help businesses steer through this challenging economic climate.

1. Early Preparation and Assessment

Conduct a Preliminary Assessment: Regularly monitor inflation rates and other economic indicators to determine if your economy is approaching hyperinflation as defined by IAS 29. This will allow you to prepare in advance.

Engage with Experts: Consult with accounting professionals who have experience with IAS 29 to understand its implications and ensure compliance.

2. Review Contracts and Agreements

Adjust Contractual Terms: Review all contracts, including those for loans, leases, and supplier agreements, to ensure that terms are adjusted for hyperinflation. This might include renegotiating terms or adding clauses that account for inflationary adjustments.

Foreign Currency Considerations: If possible, consider pricing contracts in a more stable foreign currency to mitigate the effects of hyperinflation on cash flows.

3. Focus on Cash Flow Management

Optimize Working Capital: In a hyperinflationary environment, managing cash flow becomes even more critical. Optimize your working capital by shortening payment terms with customers and negotiating longer payment terms with suppliers.

Invest in Non-Monetary Assets: Consider investing in non-monetary assets, like real estate or commodities, that are more likely to retain value during hyperinflation.

4. Adapt Pricing Strategies

Regularly Review Pricing: Frequently adjust prices to reflect the rapid changes in purchasing power and cost structures. Ensure that your pricing strategy accounts for the anticipated effects of inflation.

Implement Inflation-Linked Pricing: Where feasible, implement inflation-linked pricing mechanisms in your contracts and sales agreements.

5. Monitor Regulatory Updates

Stay Informed: Keep up to date with any changes in local accounting regulations or guidelines related to hyperinflation and IAS 29. This will help you stay compliant and avoid any legal or regulatory pitfalls.

6. Employee and Management Training

Train Your Team: Provide training for your finance and management teams on the application of IAS 29. Understanding the standard's requirements and how to implement them will be crucial for accurate financial reporting.

Prepare for Operational Changes: Educate your entire team on how hyperinflation might affect day-to-day operations, and prepare them for changes in processes and priorities.

7. Plan for Long-Term Strategy Adjustments

Reevaluate Business Strategy: Consider how hyperinflation will impact your long-term business strategy. This might include rethinking expansion plans, cost structures, or market positioning.

Scenario Planning: Engage in scenario planning to prepare for various economic outcomes, helping you to stay agile and responsive in a highly volatile environment.

Applying IAS 29 can be challenging, but with careful planning and the right strategies, your business can navigate the complexities of a hyper-inflationary economy and maintain financial stability.